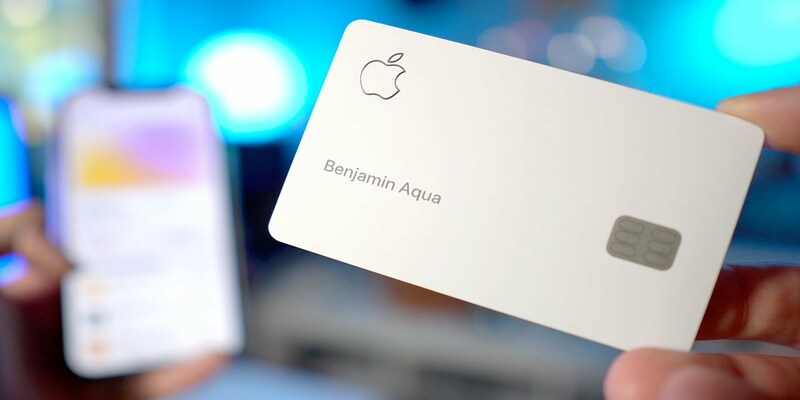

Ace Hardware is the first hardware business in a long time to join the 3% club with the Apple Card. In August of 2020, Panera Bread was introduced as a 3%-back retailer, the final time this would occur. Apple Pay using the Apple Card digital version in the Wallet app on the iPhone or Apple Watch is required for the 3% Daily Cash bonus. Even with a real Apple Card 3% Merchants, you may earn 1% Daily Cash on all purchases. For the first time, Apple Card transactions made with Apple Pay at Ace Hardware will earn 3% Daily Cash, up from the regular 2% rate. In addition to these well-known brands, several more American businesses, including Apple, Duane Reade, ExxonMobil, Nike, Uber Eats, Panera Bread, T-Mobile, Uber, as well as Walgreens, also offer 3% Daily Cash.

Apple Pay Merchants

You still need to primarily use Apple Pay with your Apple Card to get the 3% cash-back. If you enter your Apple Card number into one of these services, you will only be eligible for the 1% physical card cash back. As new retailers join the initiative, this list will be updated to reflect their participation.

What Is The Minimum Credit Score Required For The Apple Card?

Customers with credit scores under 600 are advised to apply for the Apple Store credit card as a more suitable alternative. As a result, although some candidates with fair credit (FICO scores of 580 to 669) may be approved for an Apple Card, others may be denied. If you are denied the Apple Card upon application, you may work to raise your credit score and reapply via the Path to Apple Card program.

How Much Credit Will You Get?

There are a lot of elements that Apple considers when establishing a credit limit for your Apple Card, including your income, the minimum payments on your existing debt, your credit usage ratio, and your credit score.

The Wallet app will show your Apple Card credit limit after you've been accepted for one. Select the card information icon I after tapping the ellipsis (..."). Tap the envelope symbol to start a conversation with an Apple Card expert about increasing your credit limit.

Updated Apple Card 3% Daily Cash Partners

On the launching date of the Apple Card, August 20, 2019, customers may get 3% Daily apple card 3 cash back merchants when making purchases at Apple retail locations, Apple.com, the App Store, iTunes, and Apple subscription services like Apple Music and iCloud. An additional 2% Daily Cash is awarded for all other Apple Card transactions made using Apple Pay, while the standard 1% Daily Cash is awarded for purchases made with the physical card. However, Apple said on the same day that the card's 3% Daily Cash would be accessible to an increasing number of retail partners soon following its debut. Ace Hardware will now be available on Thursday, April 19, 2022. To make it easier to keep track, we've compiled a list of all the places where you may use your Apple Card with Apple Pay and earn 3% Daily Cash.

With Your Apple Card, You May Get 3% Cash Back At Every Retailer

In all my financial dealings, I only use Apple Pay. I love that I get 2% back on my Apple Card and that it is safe and quick. Some businesses even offer 3% cash back, so only settle for the standard 2%. If you want to get the most out of your credit card benefits, it makes sense to prioritize certain establishments above others whenever feasible. If you need a reminder, here are the three levels of cash back benefits on your apple card 3 percent merchants If you use your physical card, you'll get 1% cash back at all stores; if you use Apple Pay in-store or online, you'll earn 2% cash back; and if you use Apple Pay in-store or online at any of the following stores, you'll earn 3% cash back. This amount will increase your Apple Cash balance; you may make more purchases, pay down your Apple Card balance, or withdraw cash.

Conclusion

Putting off hospice treatment because of money worries is not a good idea. All hospice care services connected to the terminal disease are covered up to 100% by Medicare Part A under the Medicare Hospice Benefit. Medicare Parts And the AB will continue to fund treatment unrelated to the terminal disease, subject to the usual restrictions (e.g., co-payments, coverage guidelines and deductibles). All costs associated with hospice care, such as doctor's visits, medicine, and supplies, are covered.